Tuesday, January 27, 2009

Marginal utility

In economics, the marginal utility of a good or of a service is the utility of the specific use to which an agent would put a given increase in that good or service, or of the specific use that would be abandoned in response to a given decrease. In other words, marginal utility is the utility of the marginal use — which, on the assumption of economic rationality, would be the least urgent use of the good or service, from the best feasible combination of actions in which its use is included.[1][2] Under the mainstream assumptions, the marginal utility of a good or service is the posited quantified change in utility obtained by using one more or one less unit of that good or service.

This concept grew out of attempts by economists to explain the determination of price. The term “marginal utility”, credited to the Austrian economist Friedrich von Wieser by Alfred Marshall,[3] was a translation of Wieser's term “Grenznutzen” (border-use).[1][2]

Marginality

Constraints are conceptualized as a border or margin.[4] The location of the margin for any individual corresponds to his or her endowment, broadly conceived to include opportunities. This endowment is determined by many things including physical laws (which constrain how forms of energy and matter may be transformed), accidents of nature (which determine the presence of natural resources), and the outcomes of past decisions made both by others and by the individual himself or herself.

A value that holds true given particular constraints is a marginal value. A change that would be effected as or by a specific loosening or tightening of those constraints is a marginal change, as large as the smallest relevant division of that good or service.[2] For reasons of tractability, it is often assumed in neoclassical analysis that goods and services are continuously divisible. In such context, a marginal change may be an infinitesimal change or a limit. However, strictly speaking, the smallest relevant division may be quite large.

Utility

- Main article: Utility

Different conceptions of utility were and have been employed during and subsequent to the development of theory employing notions of marginal utility. It has been common among economists to describe utility as corresponding to a measure, that is to say, as being quantifiable.[5][6] This has significantly affected the development and reception of theories of marginal utility. Conceptions of utility that entail quantification allow familiar arithmetic operations, and further assumptions of continuity and differentiability greatly increase tractability. However, conceptions without even weak quantification are able to consider rational preferences that would otherwise be excluded.[7]

Benthamite philosophy equated usefulness with the production of pleasure and avoidance of pain,[8] conceptualized as subject to arithmetic operation.[9] British economists, under the influence of this philosophy (especially by way of John Stuart Mill), conceptualized utility as “the feelings of pleasure and pain”[10] and further as a “quantity of feeling” (emphasis added).[11]

The Austrian School more generally attributes value to the satisfaction of needs,[12] did not depend upon a presumption of quantification,[13][7] and sometimes rejects even the possibility of quantification.[14]

The mainstream of contemporary economic theory frequently defers ontological questions, and merely notes or assumes that preference structures conforming to certain rules can be usefully proxied by associating goods, services, or uses thereof with quantities, and defines “utility” as such a quantification.[15] Recognizing that preference may be taken as the determinant of usefulness, this conception doesn't depart from the concept of usefulness.

Under any standard conception, the same object may have different marginal utilities for different people, reflecting different preferences or individual circumstances.

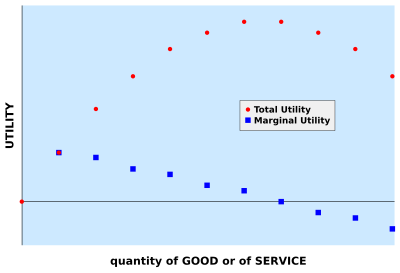

Diminishing marginal utility

An individual will typically be able to partially order the potential uses of a good or service. For example, a ration of water might be used to sustain oneself, a dog, or a rose bush. Say that a given person gives her own sustenance highest priority, that of the dog next highest priority, and lowest priority to saving the roses. In that case, if the individual has two rations of water, then the marginal utility of either of those rations is that of sustaining the dog. The marginal utility of a third unit would be that of watering the roses.

(The diminishing of utility should not necessarily be taken to be itself an arithmetic subtraction. It may be no more than a purely ordinal change.[13][7])

The notion that marginal utilities are diminishing across the ranges relevant to decision-making is called “the law of diminishing marginal utility” (and also known as a “Gossen's First Law”). However, it will not always hold. The case of the person, dog, and roses is one in which potential uses operate independently — there is no complementarity across the three uses. Sometimes an amount added brings things past a desired tipping point, or an amount subtracted causes them to fall short. In such cases, the marginal utility of a good or service might actually be increasing. For example:

- bed sheets, which up to some number may only provide warmth, but after that point may allow one to effect an escape by being tied together into a rope;

- tickets, for travel or theatre, where a second ticket might allow one to take a date on an otherwise uninteresting outing;

- dosages of antibiotics, where having too few pills would leave bacteria with greater resistance, but a full supply could effect a cure.

The fact that a tipping point may be reached does not imply that marginal utility will continue to increase indefinitely thereafter. For example, beyond some point, further doses of antibiotics would kill no pathogens at all.

Independence from presumptions of self-interested behavior

While the above example of water rations conforms to ordinary notions of self-interested behavior, the concept and logic of marginal utility are independent of the presumption that people pursue self-interest.[16] For example, a different person might give highest priority to the rose bush, next highest to the dog, and last to himself. In that case, if the individual has three rations of water, then the marginal utility of any one of those rations is that of watering the person. With just two rations, the person is left unwatered and the marginal utility of either ration is that of the dog. Likewise, a person could give highest priority to the needs of one of her neighbors, next to another, and so forth, placing her own welfare last; the concept of diminishing marginal utility would still apply.

Marginalist theory

Marginalism explains choice with the hypothesis that people decide whether to effect any given change based on the marginal utility of that change, with rival alternatives being chosen based upon which has the greatest marginal utility.

Market price and diminishing marginal utility

If an individual has a stock or flow of a good or service whose marginal utility is less than would be that of some other good or service for which he or she could trade, then it is in his or her interest to effect that trade. Of course, as one thing is traded-away and another is acquired, the respective marginal gains or losses from further trades are now changed. On the assumption that the marginal utility of one is diminishing, and the other is not increasing, all else being equal, an individual will demand an increasing ratio of that which is acquired to that which is sacrificed. (One important way in which all else might not be equal is when the use of the one good or service complements that of the other. In such cases, exchange ratios might be constant.[7]) If any trader can better his or her own marginal position by offering a trade more favorable to complementary traders, then he or she will do so.

In an economy with money, the marginal utility of a quantity is simply that of the best good or service that it could purchase.

Hence, the “law” of diminishing marginal utility provides an explanation for diminishing marginal rates of substitution and thus for the “laws” of supply and demand, as well as essential aspects of models of “imperfect” competition.

The paradox of water and diamonds

- Main article: Paradox of value

The “law” of diminishing marginal utility is said to explain the “paradox of water and diamonds”, most commonly associated with Adam Smith[17] (though recognized by earlier thinkers).[18] Human beings cannot even survive without water, whereas diamonds were in Smith's day mere ornamentation or engraving bits. Yet water had a very low price, and diamonds a very high price, by any normal measure. Marginalists explained that it is the marginal usefulness of any given quantity that determines its price, rather than the usefulness of a class or of a totality. For most people, water was sufficiently abundant that the loss or gain of a gallon would withdraw or add only some very minor use if any; whereas diamonds were in much more restricted supply, so that the lost or gained use would be much greater.

That is not to say that the price of any good or service is simply a function of the marginal utility that it has for any one individual nor for some ostensibly typical individual. Rather, individuals are willing to trade based upon the respective marginal utilities of the goods that they have or desire (with these marginal utilities being distinct for each potential trader), and prices thus develop constrained by these marginal utilities.

The “law” does not tell us such things as why diamonds are naturally less abundant on the earth than is water, but helps us to understand how this affects the value imputed to a given diamond and the price of diamonds in a market.

Quantified marginal utility

Under the special case in which usefulness can be quantified, the change in utility of moving from state S1 to state S2 is

Moreover, if S1 and S2 are distinguishable by values of just one variable  which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in

which is itself quantified, then it becomes possible to speak of the ratio of the marginal utility of the change in  to the size of that change:

to the size of that change:

(where “c.p.” indicates that the only independent variable to change is  ).

).

Mainstream neoclassical economics will typically assume that

is well defined, and use “marginal utility” to refer to a partial derivative

and diminishing marginal utility is similarly taken to correspond to